How the newly announced Stimulus Packages Affects Business

- Liz Daunt

- Mar 12, 2020

- 4 min read

Updated: Aug 10, 2020

Again yesterday the government announced further detail regarding the corona virus stimulus package. We are still waiting on further information to emerge from the ATO and government concerning the practical side of the announcements, however based on what we know the following will be coming into effect:

Small businesses with apprentices: will receive up to $21,000 in cash payments to keep apprentices in work through wage subsidies

- 50% wage subsidy for apprentices and training in business for businesses with less than 20 employees

- Being (up to) $7,000 per quarter in wage assistance to retain existing apprentices and trainees

Again we have not received the finer details on how this cash payment will be issued to businesses, however based on current information we believe this may be through the current Apprenticeship Programs run by the Australian Government.

Update - as at 10 August 2020 this support has been extended to 31 March 2021

Small to medium-sized businesses: cash payments of between $10,000 to $100,000 (was $2,000 up to $25,000) to help with cash flow

- Cash payments of between $10,000 and $100,000 to help pay wages or hire extra staff

- In the form of 100% reduction in PAYG withholding up to $50,000 for the March BAS and $50,000 for the June BAS

- Reductions apply after 28 April – therefore if the BAS is lodged before this date a credit will be applied to the business’ ATO account

- A minimum of $10,000 will be applied as a credit to the business’s ATO account even if they are not required to withhold tax from the paid salary or wages

- This payment will be eligible for the March and June 2020 quarters (or the March, April, May and June monthly BAS/IAS reporting periods)

Practical Example

Normally the BAS payable to the ATO will be $10,500. However with the reduction in PAYG withholding payable the BAS will result in the following

Total BAS Payable

As the PAYG withholding in this example is under $10,000 the minimum stimulus package amount of $10,000 will be applied to the March. The additional credits will then be utilized to reduce the net GST and overall BAS payment to $500.

If the business is not registered for GST the extra credits will be refunded to the business via direct debit transfer.

Sole Trading Businesses: If the business is not reporting wages to the ATO they are not entitled to the above stimulus package however there are now measures to assist sole traders.

Support via Jobseeker Payment (previously called Newstart) is now available for permanent employees who have lost their jobs, contract workers, self employed, casual workers and sole traders. This will provide $550 per fortnight to each person titled 'Coronavirus Supplement Payment"

Payments will commence on 27 April.

Sole Traders who see a reduction of 20% or more in trading will be able to access up to $20,000 of their superannuation.

Eligible sole traders will be able to apply online via MyGov to access $10,000 of their superannuation before 1 July 2020 and then can access a further $10,000 after 1 July 2020 for approximately 3 months.

Small Business Loans

The Australian Government is also allowing small business to access loans via banking institutions for unsecured loans up to $250,000 for 3 years. Again we are awaiting the banks to show us how this will work, eligibility and documentation required.

If your small business has an existing loan, you can also defer repayments for six months.

Businesses generally (excluding the very largest): Which will see an increase in the business asset write off including

- the instant asset write-off threshold raised to $150,000 this depreciation discount is to encourage investment however this will only apply to assets purchased between 12 March and 30 June 2020

This can increase your tax deductions/tax savings as an example

This will result in a taxable loss in which we can carry forward to future years profits. For the 2020 year and future years this will result in a tax saving of $16,500 (using a company as an example).

Under current legislation the purchase of the motor vehicle would usually save approximately $4,125 therefore with this stimulus package we are seeing extra tax savings of $12,375

- Business tax write offs increased for 15 months (til June 2021) by allowing the deduction of an additional 50% of the asset cost in the year of the purchase. The value of the asset purchased is uncapped (not restricted to $30,000 as previous Federal Budgets)

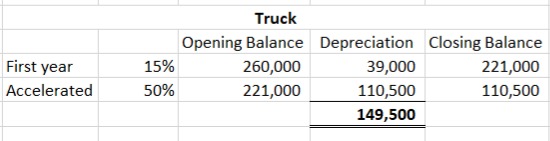

Therefore a small business would receive a deduction of 15% of the $260,000 Purchase - totalling $39,000. However with the additional deduction of 50% the total deduction and tax affect is a follows:

Therefore seeing a tax saving (for a company) in the first year of $41,112.50, bringing forward a tax saving of $30,387.50 to the 2021 tax year.

Affected businesses: access to a new $1 billion fund

- This fund will be for heavily affected industries in tourism, agriculture and education

- fee waivers and charges

- administrative relief for tax obligations including deferral of tax payments for up to 4 months

The Stimulus Package will affect many businesses and we believe that tax planning now and up to 30 June is even more critical now to ensure that you and your business can maximise it’s cashflow and tax deductions.

If you wish to discuss these changes and how they affect you – please go to our contact link and book an appointment with Liz today

Comments